Australia’s logistics sector faces unprecedented pressure as e-commerce volumes surge 23% year-on-year, forcing warehouse operators to reassess their operational strategies. A robust Return on Investment (ROI) calculation forms the foundation for any significant warehouse automation investment, yet many businesses struggle to accurately quantify the true value of these transformative technologies. The financial viability of automation extends beyond simple cost savings, encompassing enhanced operational efficiency, improved supply chain resilience, and competitive market positioning. Understanding how to properly evaluate these investments ensures that Australian businesses can make informed decisions about their logistics infrastructure. This comprehensive framework provides warehouse operators and supply chain managers with the analytical tools necessary to assess automation projects with confidence and precision.

Understanding the Core Components of Your Automation Investment

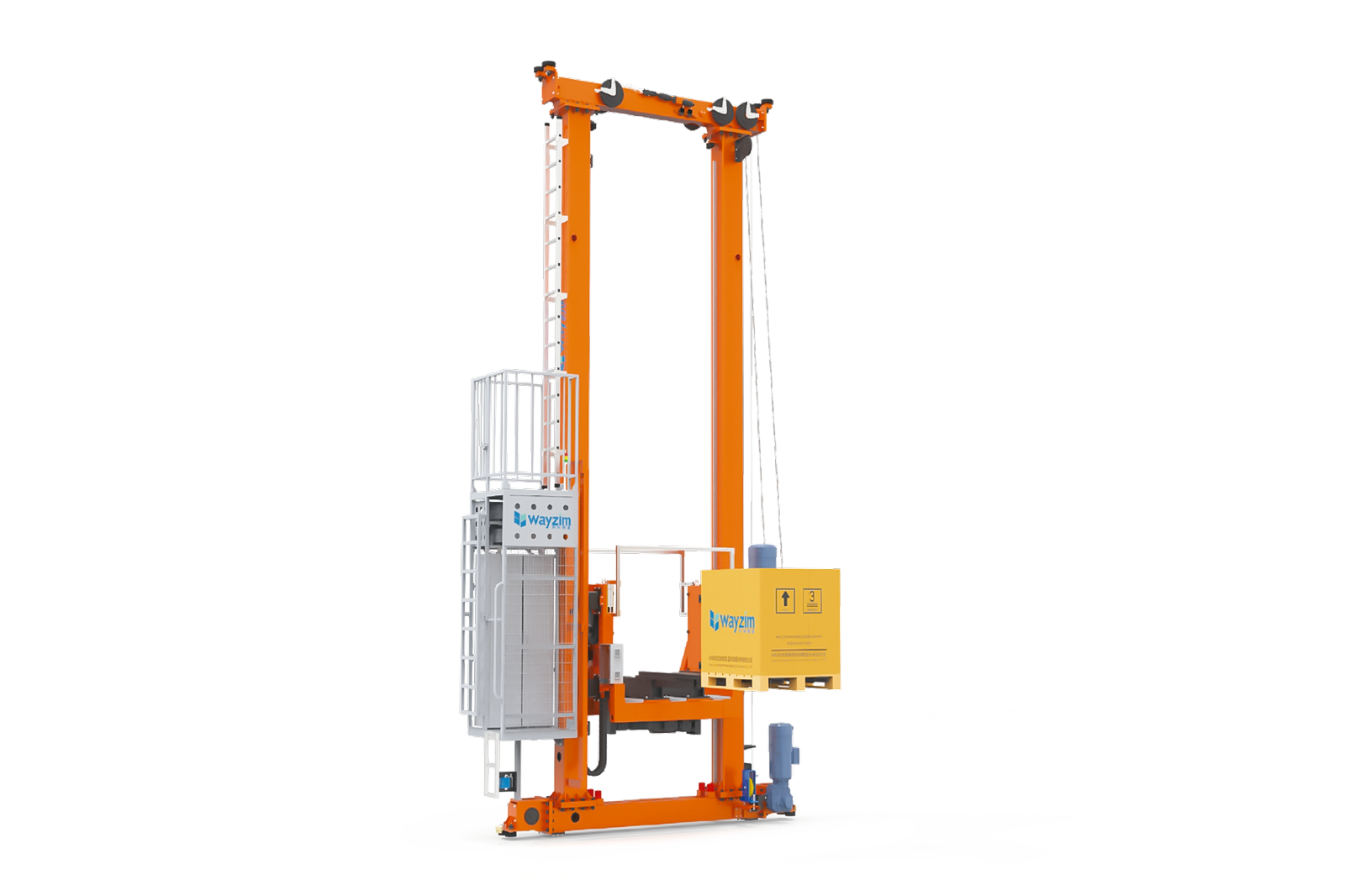

Warehouse automation represents a spectrum of interconnected solutions rather than a singular technology, each offering distinct advantages for different operational challenges. Automated Storage and Retrieval Systems (ASRS) maximise vertical space utilisation through sophisticated pallet stackers and shuttle systems, enabling warehouses to achieve storage density improvements of up to 85% compared to traditional racking. Warehouse robotics, including Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs), transform material handling by executing picking, packing, and transport tasks with precision that reduces labour dependency whilst maintaining consistent throughput rates. Conveyor and sorting systems create seamless product flow between operational zones, eliminating bottlenecks that traditionally plague manual operations.

The Warehouse Management System (WMS) serves as the central nervous system, orchestrating these various components into a cohesive ecosystem that optimises inventory movement, labour allocation, and order fulfilment. SmartlogitecX specialises in integrating these diverse warehouse systems to create tailored solutions that address specific operational requirements whilst ensuring scalability for future growth.

A Step-by-Step Guide to Calculating Your ROI

Step 1: Identify All Initial Investment Costs (CAPEX)

Calculating the true capital expenditure for warehouse automation requires comprehensive assessment beyond equipment acquisition costs alone. The investment framework must account for 1

hardware and software purchases, professional installation services, systems integration fees, and the often-overlooked infrastructure modifications including reinforced flooring, electrical upgrades, and enhanced fire suppression systems. Project management consultancy, which typically represents 10-15% of total project value, ensures smooth implementation whilst initial staff training programmes and potential operational disruption during transition phases can add $50,000-$100,000 to overall expenses. SmartlogitecX provides detailed cost breakdowns that help businesses understand exactly what the typical investment costs for implementing automated warehouse technology entail, ensuring no hidden expenses emerge during project execution.

Step 2: Project Ongoing Operational Costs (OPEX)

Understanding operational expenditure patterns proves essential for accurate long-term ROI projections, as these recurring costs significantly impact total cost of ownership. Energy consumption for automated systems typically ranges from $30,000-$80,000 annually depending on facility size, whilst scheduled maintenance contracts and spare parts inventory represent approximately 3-5% of initial equipment value per year. Software licensing fees, system updates, and technical support agreements add another layer of ongoing expense, often totalling $20,000-$40,000 annually for mid-sized operations. Specialised technical staff required to oversee automated solutions command premium salaries, though these positions generally replace multiple manual roles, creating net savings. The operating costs associated with automated solutions must be carefully modelled across the expected system lifecycle, typically 10-15 years, to establish realistic financial projections.

Step 3: Quantify All Gains and Cost Savings

The return component of ROI calculations encompasses multiple value streams that automated systems generate through enhanced operational performance. Labour savings typically represent the most substantial benefit, with businesses realising 40-60% reductions in warehouse staffing costs through strategic reallocation of human resources to higher-value activities. Productivity gains manifest through increased throughput capacity, with automated facilities processing 2-3 times more orders per hour compared to manual operations, directly impacting revenue potential. Error reduction rates of 99.9% accuracy in automated picking systems eliminate costly returns, reshipments, and customer compensation expenses that can account for 2-3% of annual revenue in traditional warehouses. Space optimisation through vertical storage and dense packing configurations often defers or eliminates warehouse expansion requirements, saving businesses $100-$200 per square metre annually in lease costs. Improved inventory management capabilities reduce carrying costs by 20-30% whilst minimising stockouts that damage customer relationships and market reputation, demonstrating how automated systems contribute to cost reductions in warehousing beyond simple labour replacement.

Step 4: Choose the Right ROI Calculation Method

Selecting appropriate financial models ensures alignment with corporate investment criteria whilst providing meaningful performance metrics for stakeholder communication. The simple payback period calculation (Total Investment ÷ Annual Savings) offers quick assessment capabilities, typically showing 2-4 year recovery periods for well-designed automation projects. Net Present Value (NPV) 2

analysis incorporates time value of money considerations, providing sophisticated evaluation for strategic investments exceeding $1 million by discounting future cash flows to present values. Internal Rate of Return (IRR) calculations express project profitability as percentage returns, enabling direct comparison between automation investments and alternative capital deployment options. SmartlogitecX recommends collaborative engagement with finance departments to ensure ROI methodologies align with established corporate standards whilst capturing the full spectrum of automation benefits. The formulas used for automation project ROI analysis should reflect both quantifiable savings and strategic value creation, acknowledging that competitive advantages and market positioning contribute substantial intangible worth.

Common Challenges and Hidden Costs to Avoid

Successful automation implementation requires vigilant attention to potential pitfalls that can erode projected returns if not properly anticipated and managed. Integration complexity with existing WMS and ERP systems frequently exceeds initial estimates, potentially adding 20-30% to project timelines and budgets when legacy infrastructure requires substantial modification. Change management programmes, encompassing comprehensive staff retraining and cultural transformation initiatives, demand investment of $75,000-$150,000 to ensure smooth adoption and prevent productivity losses during transition periods. Operational disruption during implementation phases can reduce facility capacity by 30-50% for several weeks, necessitating contingency planning and potential overflow facility arrangements. Future scalability requirements and technology obsolescence considerations mandate selection of modular, upgradeable systems rather than rigid solutions that limit growth potential. The potential hidden costs in warehouse automation initiatives extend to increased insurance premiums, specialised recruitment expenses, and ongoing technology refresh cycles that must be incorporated into financial planning frameworks.

Final Thoughts on Justifying Your Automation Project

Comprehensive ROI analysis serves as both financial validation tool and strategic planning instrument, enabling businesses to build compelling cases for warehouse automation investments that extend beyond numerical justifications. The multifaceted benefits encompass enhanced workplace safety through reduced manual handling injuries, elevated customer satisfaction via improved order accuracy and faster fulfilment, and strengthened competitive positioning in increasingly demanding markets. SmartlogitecX located in Sydney partners with Australian businesses to develop robust business cases that capture both tangible returns and strategic advantages, ensuring investment decisions reflect complete value propositions. Forward-thinking organisations recognise that SmartlogitecX warehouse automation represents essential infrastructure for future growth rather than optional efficiency improvement, positioning early adopters to capture market share as customer expectations continue escalating. The strategic planning process initiated through thorough ROI calculation establishes foundations for successful implementation, ongoing optimisation, and sustained competitive advantage in Australia’s evolving logistics landscape.

Frequently Asked Questions

1.What is a good ROI for a warehouse automation project?

A well-designed warehouse automation project should achieve 20-30% annual ROI, with payback periods between 2-4 years depending on implementation scope and operational complexity.

2.How long does it typically take to see a return on an ASRS investment?

ASRS investments typically demonstrate positive returns within 24-36 months, though high-volume operations may achieve payback in as little as 18 months through accelerated throughput gains.

3.Why is calculating ROI so important before implementing automated systems?

ROI calculations provide essential financial validation, identify optimal technology selections, establish performance benchmarks, and secure stakeholder buy-in for significant capital investments.

4.What are the biggest financial benefits of automating a distribution centre?

Labour cost reductions of 40-60%, throughput increases of 200-300%, and error rate improvements delivering 99.9% accuracy represent the primary financial advantages.

5.How do I account for intangible benefits like improved worker safety in my ROI?

Quantify safety improvements through reduced insurance premiums, decreased workers’ compensation claims, lower recruitment costs, and improved staff retention rates.

6.Are there government incentives or grants available for technology adoption?

Australian federal and state governments offer various grants including the Manufacturing Modernisation Fund and Export Market Development Grants that can offset 25-50% of eligible automation expenses.

7.What are the most common hidden costs in an automation project?

Integration complexity, change management programmes, operational disruption, infrastructure modifications, and ongoing technical support frequently exceed initial budget projections.

8.How does automation impact labour costs in a warehouse?

Automation reduces overall labour expenses by 40-60% whilst shifting workforce composition toward higher-skilled technical positions commanding premium salaries.

9.Can small to medium-sized businesses also achieve positive ROI on automation?

SMEs increasingly access scalable automation solutions with modular implementations starting from $250,000, achieving comparable ROI percentages to larger installations.

10.What key metrics should I track after implementation to validate my ROI calculation?

Monitor cost per unit shipped, order accuracy rates, inventory turns, labour productivity ratios, and total throughput volumes against projected baselines to confirm ROI achievement.